Iron ore futures edged lower on Friday as market remained cautious amid an uncertain demand outlook.

Rising inventories at major Chinese ports and increasing global supply continue to pressure prices, reflecting slower restocking by Chinese steel mills.

Although finished steel inventories are still declining, the pace has slowed, signaling weaker demand heading into the winter season, when steel consumption typically drops.

Despite Friday’s dip, the most-traded iron ore contract still posted a small weekly gain, supported earlier by improving U.S.-China trade sentiment and expectations of U.S. Federal Reserve rate cuts.

Even so, the broader outlook remains bearish. Ongoing weakness in China’s property sector and growing protectionist measures against Chinese steel exports threaten to curb export activity, which has helped offset domestic demand softness this year.

Chinese steel traders noted that fundamentals in the physical market have seen little improvement, with no strong upside drivers emerging.

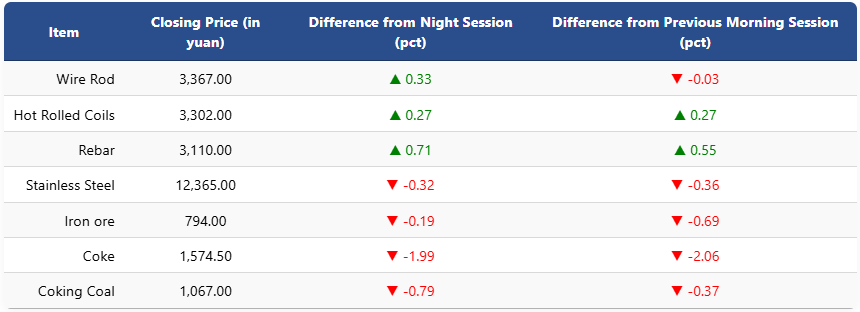

On the Dalian Commodity Exchange, the most-traded January iron ore contract slipped 0.19pct to 794 yuan (USD 112.2) per ton, though it still logged a 0.44pct gain compared with last Friday’s morning session.

Coking coal fell 0.79pct to 1,067 yuan (USD 151), while coke dropped 1.99pct to 1,574.5 yuan (USD 223) a ton.

On the Shanghai Futures Exchange, rebar rose 0.71pct to 3,110 yuan (USD 440), HRC increased 0.27pct to 3,302 yuan (USD 467), wire rod added 0.33pct to 3,367 yuan (USD 476), and stainless steel eased 0.32pct to 12,365 yuan (USD 1,748) per ton.

1 USD / 7.07 yuan