Iron ore futures continued to rise on Tuesday, supported by short-term restocking ahead of the winter season, though a fragile demand outlook kept gains in check. Analysts said mills are replenishing inventories to avoid weather-related disruptions, offering limited support to prices.

However, fundamentals remain weak. Soft steel demand is weighing on finished steel prices, while high port-side iron ore inventories continue to pressure sentiment. A Chinese steel trader noted that physical market conditions are largely unchanged, with excess supply and sluggish downstream demand keeping steel prices under pressure.

To ease margin pressure, many Chinese steel mills are reportedly bringing forward maintenance, which could reduce near-term iron ore consumption.

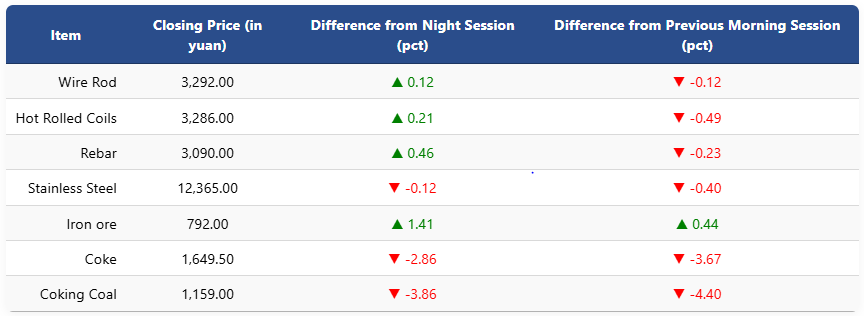

On the Dalian Commodity Exchange, the most-traded January iron ore contract rose 1.41pct to 792 yuan (USD 111.3) per ton. Coking coal fell 3.86pct to 1,159 yuan (USD 163), and coke declined 2.86pct to 1,649.5 yuan (USD 232) a ton.

On the Shanghai Futures Exchange, rebar gained 0.46pct to 3,090 yuan (USD 435), HRC edged up 0.21pct to 3,286 yuan (USD 462), and wire rod also inched higher to 3,292 yuan (USD 463). Stainless steel slipped to 12,365 yuan (USD 1,739) per ton.

1 USD / 7.11 yuan