Iron ore futures edged higher on Wednesday, supported by steady near-term demand, though a bearish outlook continues to cap gains.

Some Chinese steel mills are replenishing iron ore inventories ahead of the winter season, offering limited support to prices. Analysts noted that although steel production has eased in recent weeks, overall output remains relatively high, helping sustain iron ore consumption.

China’s major steel-producing provinces recorded crude steel production of 583.47 mln tons in January-October, down 4.3pct YoY, according to the National Bureau of Statistics.

However, sentiment remains weak. Excess steel supply, sluggish downstream demand, and falling finished steel prices are squeezing mill margins, raising the risk of deeper output cuts. Rising global iron ore supply and high port inventories are also weighing on the outlook.

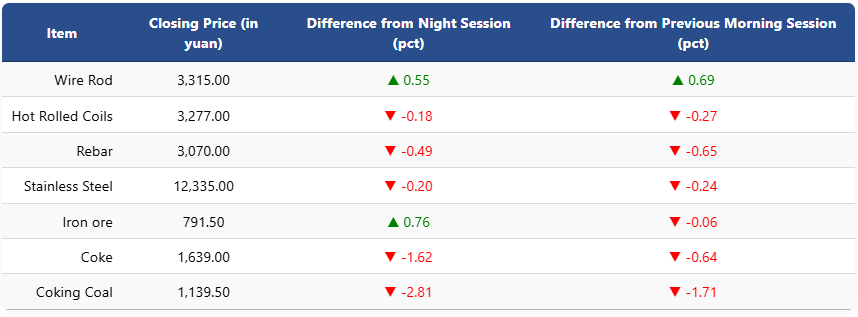

On the Dalian Commodity Exchange, the most-traded January iron ore contract rose 0.76pct to 791.5 yuan (USD 111.3) per ton. Coking coal dropped 2.81pct to 1,139.5 yuan (USD 160), while coke fell 1.62pct to 1,639 yuan (USD 231).

On the Shanghai Futures Exchange, rebar slipped 0.49pct to 3,070 yuan (USD 432), HRC fell 0.18pct to 3,277 yuan (USD 461), and stainless steel eased 0.2pct to 12,335 yuan (USD 1,735). Wire rod rose 0.55pct to 3,315 yuan (USD 466).

1 USD / 7.1 yuan