Iron ore futures edged higher on Monday, supported by tighter supply and expectations of fresh policy measures from Beijing, though the market’s longer-term outlook remains uncertain.

Traders reported a week-on-week drop in iron ore supply, offering some near-term support even as port inventories stay elevated.

Sentiment was also influenced by a Reuters report that China’s state-owned iron ore buyer has instructed mills to halt purchases of a specific BHP product, escalating an ongoing contract dispute.

In addition, Bloomberg reported last week that Beijing may roll out a more aggressive stimulus package for its struggling property sector, formerly a major driver of steel demand, providing another boost to iron ore prices.

However, seasonal winter slowdown in steel consumption continues to cap gains. The China Iron & Steel Association (CISA) said steel prices are likely to remain under pressure due to higher finished-steel inventories during the traditional winter demand lull.

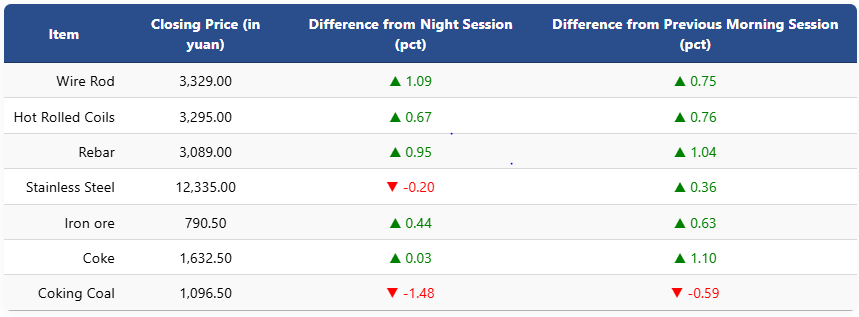

On the Dalian Commodity Exchange, the most-traded January iron ore contract rose 0.44pct to 790.5 yuan (USD 111.2) per ton. Coking coal fell 1.48pct to 1,096.5 yuan (USD 154), while coke inched up to 1,632.5 yuan (USD 230).

On the Shanghai Futures Exchange, rebar gained 0.95pct to 3,089 yuan (USD 435), HRC increased 0.67pct to 3,295 yuan (USD 464), and wire rod rose 1.09pct to 3,329 yuan (USD 469). Stainless steel slipped 0.2pct to 12,335 yuan (USD 1,737) per ton.

1 USD / 7.10 yuan