Iron ore futures inched higher on Wednesday, supported by a pickup in steel production, though demand concerns continued to cap gains.

The China Iron & Steel Association (CISA) reported that its member mills produced an average of 1.94 mln tons of crude steel per day between November 11-20, up 0.9pct from the first ten days of the month but still 6.6pct lower YoY.

Chinese steel traders noted that ongoing destocking of finished steel inventories has eased some pressure on prices, yet upside drivers remain limited as the traditional winter slowdown keeps demand subdued.

Rising global iron ore supply and elevated port inventories also constrained gains. Meanwhile, shrinking steel mill margins may prompt producers to cut output or advance maintenance plans, reducing iron ore consumption and adding to the bearish outlook.

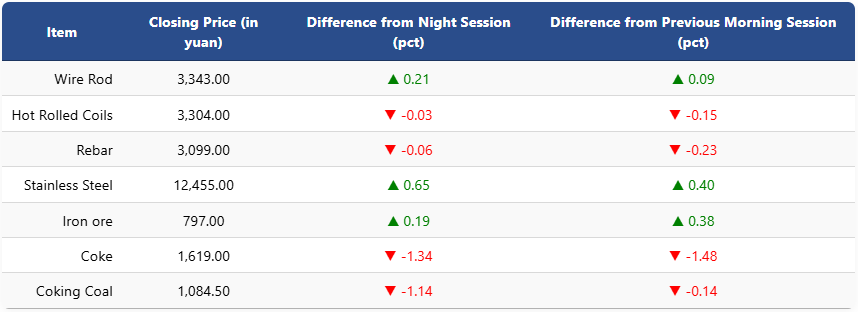

On the Dalian Commodity Exchange, the most-traded January iron ore contract edged up 0.19pct to 797 yuan (USD 112.6) per ton. Coking coal fell 1.14pct to 1,084.5 yuan (USD 153), and coke declined 1.34pct to 1,619 yuan (USD 229) a ton.

On the Shanghai Futures Exchange, rebar and HRC slipped to 3,099 yuan (USD 438) and 3,304 yuan (USD 467) per ton, respectively. Wire rod rose 0.21pct to 3,343 yuan (USD 472), while stainless steel gained 0.65pct to 12,455 yuan (USD 1,760) per ton.

1 USD / 7.07 yuan