Iron ore futures posted gains on Friday, supported mainly by sentiment-driven expectations, while underlying fundamentals remained weak.

Iron ore futures were subdued earlier in the session after China’s state planner, the National Development and Reform Commission, reiterated its commitment to regulate crude steel output and prevent the addition of illegal new capacity during 2026-2030.

However, sentiment later improved on expectations that declining steel supply could lift steelmakers’ margins by easing pressure on finished steel prices. Analysts noted that recent cuts in steel production have helped stabilize finished steel prices, which could support mill profitability. Restrictions on certain BHP products also lent some support to iron ore, although higher portside inventories continued to cap gains. Recent property support measures in Beijing further underpinned sentiment.

Chinese steel traders said falling inventories of major finished steel products have strengthened prices in the physical market. They added that exports could pick up once there is more clarity on the steel export licensing system due to take effect from January 1, 2026. Overall, traders described market conditions as stable but lacking strong upside drivers.

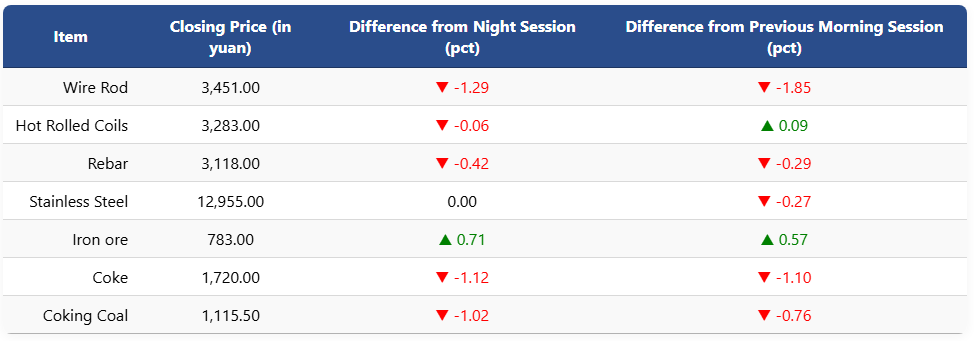

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose 0.71pct to 783 yuan (USD 111.7) per ton, up 0.38pct from last Friday’s morning close. Coking coal futures fell 1.02pct to 1,115 yuan (USD 159) per ton, while coke futures dropped 1.12pct to 1,720 yuan (USD 245) per ton.

On the Shanghai Futures Exchange, rebar futures declined 0.42pct to 3,118 yuan (USD 445) per ton, while HRC edged down 0.06pct to 3,283 yuan (USD 468) per ton. Wire rod fell 1.29pct to 3,451 yuan (USD 493) per ton, while stainless steel futures were unchanged at 12,955 yuan (USD 1,849) per ton.

1 USD / 7 yuan