Iron ore futures surged on Monday, driven by improved sentiment after Beijing signaled a more proactive fiscal policy stance for 2026.

China will adopt a more expansionary fiscal approach next year, increasing spending support while focusing on efficiency and structural optimization, according to a national fiscal work conference held by the China Ministry of Finance in Beijing.

Improved profitability of Chinese steel mills, along with anticipated restocking ahead of the Chinese New Year holidays in February, also supported iron ore prices.

However, fundamentals in the physical steel market remained largely unchanged. Some Chinese steel traders said demand is stable but not improving, limiting near-term upside for steel prices.

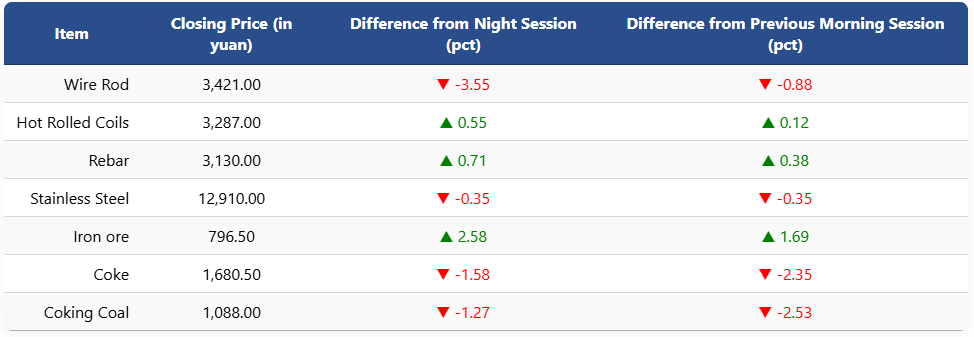

On the Dalian Commodity Exchange, the most-traded May iron ore contract jumped 2.58pct to 796.5 yuan (USD 113.6) per ton. Coking coal futures fell 1.27pct to 1,088 yuan (USD 155) per ton, while coke futures declined 1.58pct to 1,680.5 yuan (USD 240) per ton.

On the Shanghai Futures Exchange, rebar futures rose 0.71pct to 3,130 yuan (USD 447) per ton, while HRC gained 0.55pct to 3,287 yuan (USD 469) per ton. Wire rod dropped 3.55pct to 3,421 yuan (USD 488) per ton, and stainless steel futures slipped 0.35pct to 12,910 yuan (USD 1,842) per ton.

1 USD / 7 yuan