Iron ore futures edged lower on Wednesday in the final morning session of 2025, with market sentiment weighed down by weak fundamentals. Rising global supply, elevated inventories at major Chinese ports, and subdued steel demand continued to pressure prices.

Adding to the cautious outlook, China’s steel industry Purchasing Managers’ Index (PMI) fell for a second consecutive month to 46.3 in December, according to the CFLP Steel Logistics Professional Committee, reflecting a seasonal winter slowdown.

However, broader economic indicators provided some support. Official data from the National Bureau of Statistics showed China’s manufacturing PMI rebounded to 50.1 in December from 49.2 in November, returning to expansion territory. The non-manufacturing PMI also improved to 50.2 from 49.5, signaling a modest recovery in services activity.

Expectations of iron ore restocking ahead of the Chinese New Year holidays in February, along with the prospect of higher steel output as mills resume production after scheduled maintenance, helped limit further losses in iron ore prices.

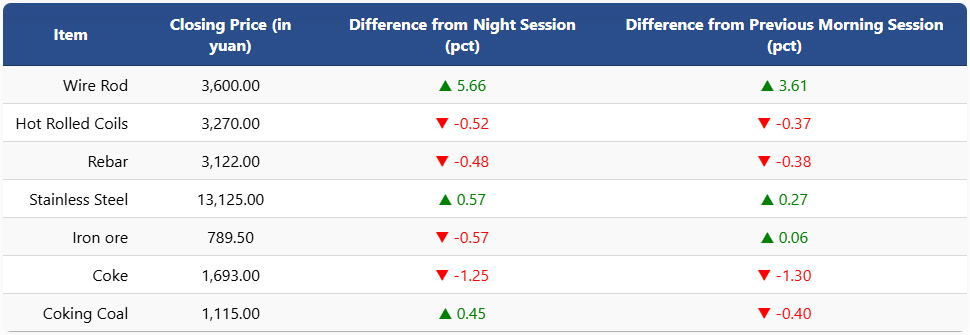

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 0.57pct to 789.5 yuan (USD 112.9) per ton. Coking coal futures rose 0.45pct to 1,115 yuan (USD 159) per ton, while coke futures declined 1.25pct to 1,693 yuan (USD 242) per ton.

On the Shanghai Futures Exchange, rebar futures dropped 0.48pct to 3,122 yuan (USD 447) per ton and HRC slipped 0.52pct to 3,270 yuan (USD 468) per ton. Wire rod surged 5.66pct to 3,600 yuan (USD 515) per ton, while stainless steel futures gained 0.57pct to 13,125 yuan (USD 1,877) per ton.

On an annual basis compared with the morning close on December 31, 2024, iron ore futures posted a 1.35pct gain, while coking coal and coke declined by 3.92pct and 6.57pct, respectively. On the SHFE, rebar and HRC fell 5.65pct and 4.33pct YoY, while wire rod and stainless steel recorded gains of 1.41pct and 1.63pct, respectively.

1 USD / 6.99 yuan