Chinese HRC prices remained under pressure in 2025, with UAE import patterns highlighting booking lags and global supply dynamics. Chinese HRC prices into the UAE on a CFR Jebel Ali basis, as assessed by MEsteel, moved within a relatively narrow but persistently pressured range during 2025, with price erosion through mid-year amplified by heavy import inflows that largely reflected earlier booking activity rather than real-time demand.

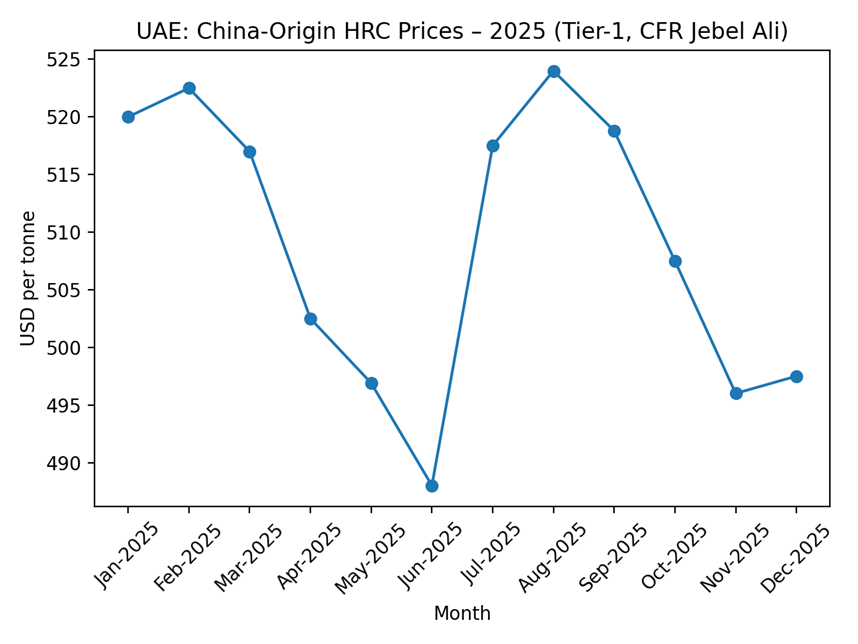

At the start of 2025, Chinese origin HRC (3mm base, commercial quality) averaged around USD 520-523 per ton CFR Jebel Ali, supported by post-year-end restocking and stable export sentiment. However, this period of price stability coincided with elevated import volumes, as material booked in late 2024 and early 2025 continued to arrive into the UAE market.

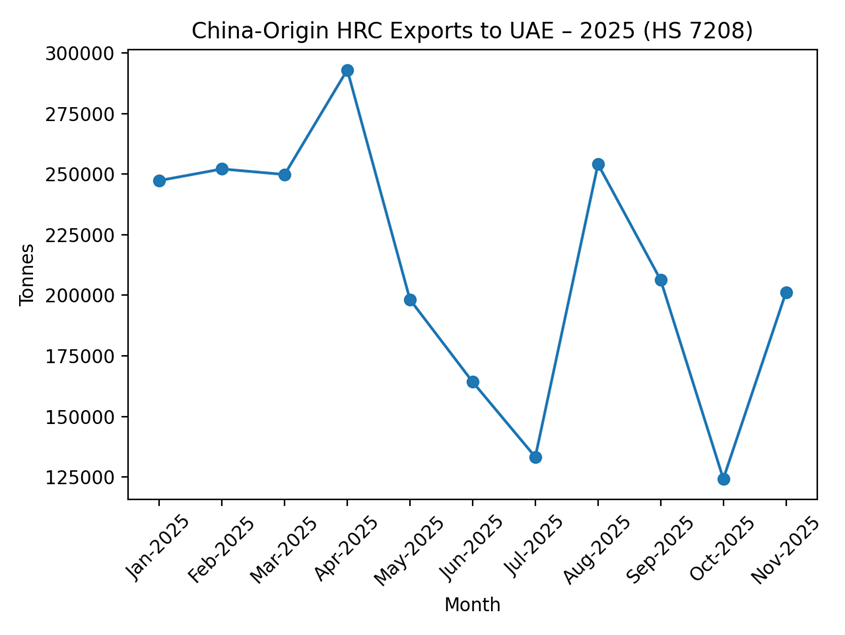

China Customs data show that exports of hot-rolled flat steel (HS 7208) from China to the UAE averaged approximately 250,000 tons per month during January-March 2025, before increasing further to nearly 293,000 tons in April, the highest monthly level recorded during the year.

As downstream demand from the UAE’s construction and manufacturing sectors softened, prices gradually came under pressure. By mid-2025, Chinese origin HRC prices declined to their annual low, averaging around USD 488 per ton CFR Jebel Ali in June, marking a steady erosion from early-year levels.

Import volumes adjusted with a clear lag. While prices weakened from March onward, arrivals only began to decline meaningfully from May, falling to around 198,000 tons in May, 164,000 tons in June, and bottoming out at approximately 133,000 tons in July. This divergence highlights the impact of booking-to-arrival delays, with material arriving during the first half of the year largely reflecting purchases made when prices were still higher.

A temporary recovery emerged in late Q3. Chinese origin HRC prices rebounded to an average of around USD 524 per ton CFR Jebel Ali in August. This coincided with a renewed rise in arrivals, as August imports surged to about 254,000 tons, likely reflecting bookings made during the mid-year price trough. However, the rebound lacked structural support, and buying interest remained cautious as demand fundamentals failed to improve materially.

The final quarter of 2025 was characterized by volatile import flows and range-bound pricing. Imports dropped sharply in October to roughly 124,000 tons, before rebounding to just over 200,000 tons in November, reflecting uneven booking behavior rather than a sustained recovery in demand. By year-end, Chinese origin HRC prices stabilized just below USD 500 per ton CFR Jebel Ali, with buyers largely operating on a need-to-buy basis and sellers defending price floors amid limited upside catalysts.