Iron ore futures fell on Monday as softening fundamentals ahead of the Chinese New Year holidays dampened market sentiment.

Rising iron ore inventories at major Chinese ports and slower restocking activity are expected to keep prices under pressure in the near term.

Weak steel demand and environmentally driven production curbs are also weighing on output expectations, limiting iron ore consumption.

The downturn was compounded by a broad sell-off across commodities, with sharp losses in gold, silver, oil and base metals after reports that Kevin Warsh could be the next U.S. Federal Reserve chair. Analysts said markets view Warsh as relatively hawkish, triggering another wave of risk-off selling that pushed precious metals lower for a second straight session.

Mixed macroeconomic signals added to the pressure. China’s official manufacturing purchasing managers’ index slipped to 49.3 in January from 50.1 in December, according to data from the National Bureau of Statistics. Analysts attributed the decline largely to seasonal effects, base factors and weak domestic demand. In contrast, a private-sector survey by RatingDog, which focuses more on private and export-oriented firms, showed PMI edging up to 50.3 in January 2026 from 50.1 in December.

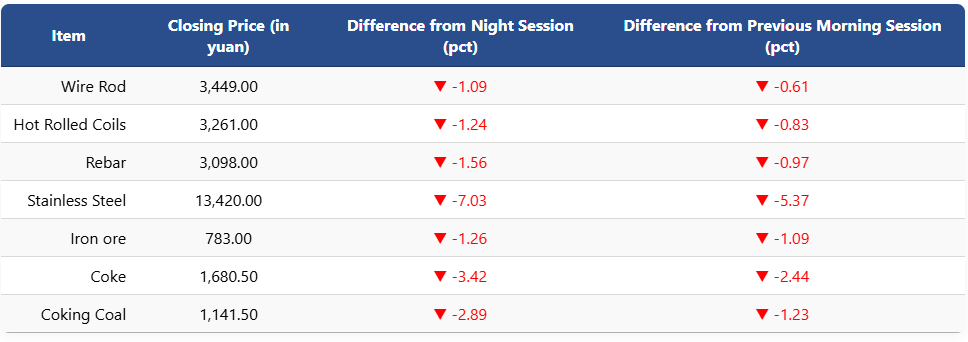

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 1.26pct to 783 yuan (USD 112.7) per ton. Coking coal and coke futures dropped 2.89pct and 3.42pct to 1,141.5 yuan (USD 164) per ton and 1,680.5 yuan (USD 242) per ton, respectively.

Meanwhile, on the Shanghai Futures Exchange, rebar futures declined 1.56pct to 3,098 yuan (USD 446) per ton, while HRC slipped 1.24pct to 3,261 yuan (USD 470). Wire rod futures fell 1.09pct to 3,449 yuan (USD 497). Stainless steel futures plunged 7.03pct to 13,420 yuan (USD 1,933) per ton, tracking the broader commodity rout, particularly sharp losses in nickel.

1 USD / 6.94 yuan