Iron ore futures stayed under pressure on Thursday as a bearish demand outlook continued to weigh on sentiment. Analysts noted that soft steel demand has largely been priced in, but the absence of strong positive drivers has kept the market stuck in a narrow range.

Some analysts expect a short-term pickup in long steel demand before winter sets in, as construction activity typically slows during the colder months. This could prompt Chinese mills to replenish iron ore inventories ahead of the seasonal lull.

Iron ore remains weighed down by weak steel demand and earlier high production levels that continue to pressure finished steel prices. Chinese mills are gradually cutting output, bringing forward maintenance schedules, due to shrinking profitability and the usual winter slowdown. Rising protectionist measures against Chinese steel exports, despite their strong performance this year, have added further uncertainty.

Additional pressure is coming from growing global supply and higher port inventories, both of which have dampened market sentiment.

Steel traders said physical market prices remain stuck in the same cycle due to a lack of demand catalysts, though sentiment has improved slightly compared to last month, still not enough to lift prices.

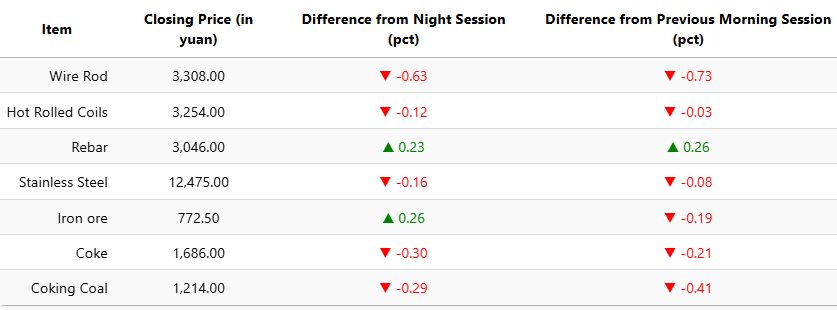

On the Dalian Commodity Exchange, the most-traded January iron ore contract edged up 0.26pct to 772.5 yuan (USD 108.8) per ton. Coking coal slipped 0.29pct to 1,214 yuan (USD 171), while coke dipped 0.3pct to 1,686 yuan (USD 237) per ton.

On the Shanghai Futures Exchange, rebar rose 0.23pct to 3,046 yuan (USD 429), while HRC eased 0.12pct to 3,254 yuan (USD 458). Wire rod fell 0.63pct to 3,308 yuan (USD 466), and stainless steel inched down 0.16pct to 12,475 yuan (USD 1,758) per ton.

1 USD / 7.09 yuan