Iron ore futures extended gains on Friday, supported by expectations of near-term restocking, although weak fundamentals continued to limit the upside.

Some market participants expect Chinese steel mills to replenish inventories ahead of the Lunar New Year holidays in mid-February, providing short-term support to prices. However, underlying fundamentals remain soft, with China’s steel output continuing to decline and iron ore inventories at major ports rising. While lower steel production has eased pressure on finished steel prices and may help improve mill margins in the near term, demand conditions remain fragile.

Several analysts view the recent rally as largely speculative, warning that iron ore prices could come under pressure next year as China steps up efforts to rein in steel capacity. The China Iron and Steel Association (CISA) has recently reiterated the need to improve industry profitability through tighter self-regulation and more disciplined export management.

Australia, a major iron ore exporter, has also signaled a weaker price outlook. The country’s Department of Industry, Science and Resources forecasts iron ore prices (62pct Fe fines) to average USD 87 per ton in 2025, down from USD 93 per ton in 2024, before easing further to USD 85 per ton in 2026 and USD 82 per ton in 2027, citing rising global supply.

Meanwhile, Beijing has moved to introduce a steel export licensing system to curb outbound shipments after record exports this year, which helped offset weak domestic demand but increased global trade frictions. Signals from December’s Central Economic Work Conference also suggest China will prioritize policies aimed at boosting consumption on both the supply and demand sides.

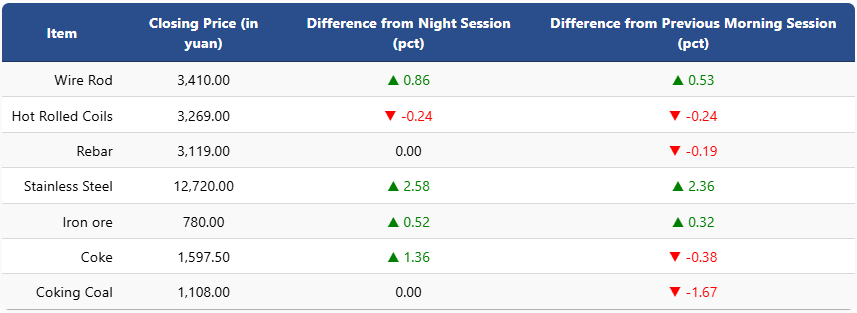

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose 0.52pct to 780 yuan (USD 110.7) per ton, marking a 2.56pct gain compared with last Friday’s morning close. Coking coal futures were flat at 1,108 yuan per ton, while coke climbed 1.36pct to 1,597.5 yuan per ton.

On the Shanghai Futures Exchange, rebar futures were unchanged at 3,119 yuan per ton, HRC edged down 0.24pct to 3,269 yuan per ton, wire rod rose 0.86pct to 3,410 yuan per ton, and stainless steel futures jumped 2.58pct to 12,720 yuan per ton.

1 USD / 7.04 yuan