Iron ore futures edged higher on Monday, though the overall demand outlook remained cautious as the market continued to assess underlying fundamentals.

Market participants believe most negative factors, such as higher portside iron ore inventories, declining steel output, and a seasonal winter slowdown in steel demand, have largely been priced in.

Support for iron ore prices has emerged from an ongoing commercial dispute between China Mineral Resources Group (CMRG) and BHP. Analysts noted that CMRG has restricted purchases of certain low-grade BHP products, raising concerns about near-term supply tightness. In addition, reduced steel production has contributed to lower finished steel inventories in the domestic market, easing downward pressure on steel prices. This has helped stabilize margins at Chinese steel mills, thereby improving the outlook for iron ore demand.

Chinese steel traders reported no material improvement in underlying steel demand, although recent price declines have attracted cautious buying interest. Many traders also pointed out that market activity remains focused on shipping material by the end of December, ahead of the implementation of a new export licensing regime.

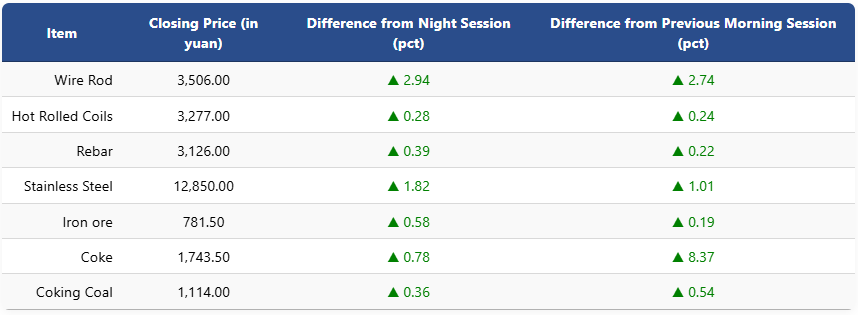

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose 0.52pct to 781.5 yuan (USD 111) per ton. Coking coal futures increased 0.36pct to 1,114 yuan (USD 158) per ton, while coke futures climbed 0.78pct to 1,743.5 yuan (USD 248) per ton.

On the Shanghai Futures Exchange, rebar futures gained 0.39pct to 3,126 yuan (USD 444) per ton, while HRC edged up 0.28pct to 3,277 yuan (USD 466) per ton. Wire rod surged 2.94pct to 3,506 yuan (USD 498) per ton, and stainless steel futures jumped 1.82pct to 12,850 yuan (USD 1,826) per ton.

1 USD / 7.03 yuan