Iron ore futures edged higher on Wednesday as expectations of improved demand provided some support, though gains were limited by weak underlying fundamentals, keeping market sentiment cautious.

Analysts said Beijing is increasingly focused on boosting domestic demand and slowing record steel exports next year. Earlier this year, Chinese authorities launched an “involution” campaign aimed at curbing excessive competition and aggressive price wars in sectors such as steel and automotive, which have contributed to deflationary pressures. At the same time, policymakers have rolled out several measures to stabilize the troubled property sector, with further support expected. While property was once China’s main steel-consuming sector, its decline has not been fully offset by infrastructure or manufacturing demand.

In addition, China’s plan to introduce steel export licensing from January 1, 2026, has reinforced expectations that authorities want to prioritize higher value-added steel exports. China’s steel exports remain on track to reach historically high levels, totaling 107.7 mln tons in Jan-Nov 2025. This surge in exports has also triggered trade frictions with several countries, prompting the introduction of anti-dumping duties and other protectionist measures against Chinese steel products.

Reflecting the cautious outlook, major Chinese steelmaker Shagang Group kept its long steel prices unchanged for late-December sales.

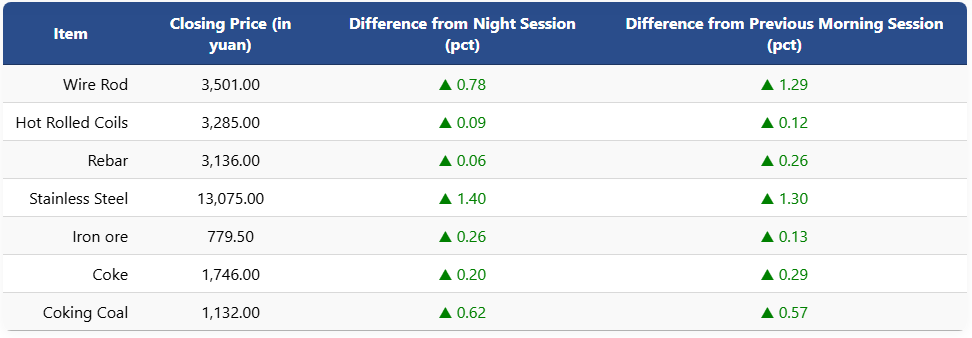

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose 0.26pct to 779.5 yuan (USD 111) per ton. Coking coal futures increased 0.62pct to 1,132 yuan (USD 161) per ton, while coke futures edged up 0.2pct to 1,746 yuan (USD 249) per ton.

On the Shanghai Futures Exchange, rebar and HRC futures edged higher to 3,136 yuan (USD 447) per ton and 3,285 yuan (USD 468) per ton, respectively. Wire rod rose 0.78pct to 3,501 yuan (USD 499) per ton, while stainless steel futures gained 1.4pct to 13,075 yuan (USD 1,864) per ton.

1 USD / 7.01 yuan