Iron ore futures rose on Thursday, supported by improved sentiment following Beijing’s latest measures to support the troubled property sector, although weak market fundamentals continued to limit gains.

China announced a new package of property policy adjustments effective December 24, easing home-buying qualification. Policymakers have rolled out several support measures this year, with further steps expected. However, the property sector, once China’s largest steel consumer, has lost momentum since 2021, and weaker construction demand has only been partly offset by infrastructure and manufacturing, resulting in an overall decline in steel consumption.

Market participants are hoping that an improvement in steel demand next month will encourage Chinese mills to step up iron ore restocking, though high portside inventories remain a key concern.

Overall, the iron ore outlook remains largely bearish amid the risk of environmental curbs on heavy industry, a potential slowdown in steel exports next year, and rising global supply.

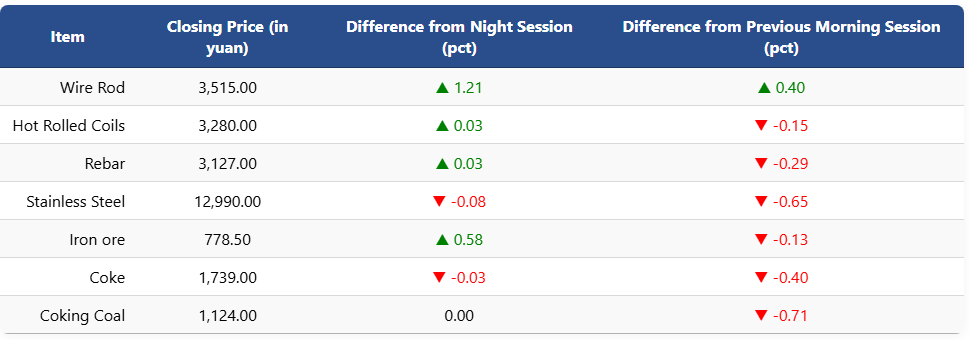

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose 0.58pct to 778.5 yuan (USD 111.1) per ton. Coking coal futures were unchanged at 1,124 yuan (USD 160) per ton, while coke futures edged down to 1,739 yuan (USD 248) per ton.

On the Shanghai Futures Exchange, rebar and HRC futures edged higher to 3,127 yuan (USD 446) per ton and 3,280 yuan (USD 468) per ton, respectively. Wire rod gained 1.21pct to 3,515 yuan (USD 502) per ton, while stainless steel futures slipped 0.08pct to 12,990 yuan (USD 1,854) per ton.

1 USD / 7 yuan