The latest short-range outlook from the World Steel Association (Worldsteel) projects sustained growth in steel demand across the Middle East and North Africa (MENA) over the next two years, following a sharp expansion in 2024.

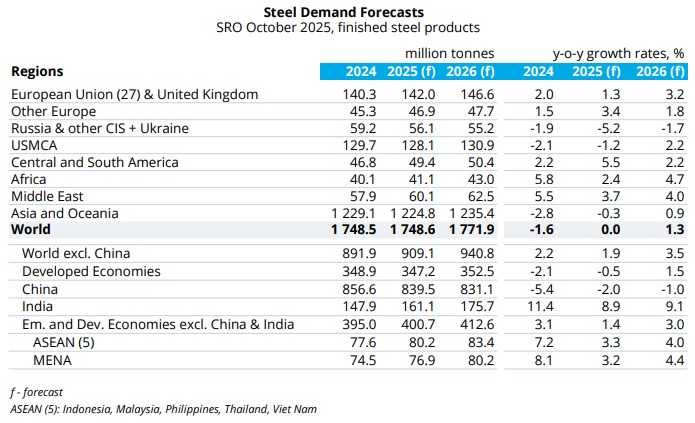

MENA steel demand is expected to rise 3.2pct YoY to 76.9 mln tons in 2025, and a further 4.4pct to 80.2 mln tons in 2026, after last year’s robust 8.1pct increase to 74.5 mln tons.

Middle East consumption is forecast to grow 3.7pct to 60.1 mln tons in 2025 and 4pct to 62.5 mln tons in 2026, while Africa is set for modest 0.3pct growth this year, before rebounding by 4.7pct to 43 mln tons in 2026.

Worldsteel highlighted that Africa’s demand, which stagnated around 35-40 mln tons for nearly a decade, has been gaining momentum since 2023. Improved macroeconomic stability, governance, and diversification reforms across several African economies are supporting this recovery, with average demand growth of 5.5pct annually in recent years.

Turkey’s demand is projected to grow 3.7pct in 2025 to 39.7 mln tons, before slowing to 1.5pct in 2026 at 40.3 mln tons.

Globally, steel demand is forecast to remain flat in 2025 at 1.75 bln tons, before recovering by 1.3pct to 1.77 bln tons in 2026. Demand outside China is set to grow by 1.9pct in 2025 and 3.5pct in 2026, driven by India, ASEAN, and MENA. India remains the standout performer, with demand projected to grow 8.9pct in 2025 to 161.1 mln tons, and 9.1pct in 2026 to 175.7 mln tons.

China’s demand, by contrast, is expected to continue its gradual decline, down 2pct in 2025 to 839.5 mln tons and another 1pct in 2026 to 831.1 mln tons, reflecting ongoing weakness in the housing sector and fiscal pressures on local governments.

Commenting on the outlook, Alfonso Hidalgo de Calcerrada, Chief Economist at the Spanish Steel Producers Association (UNESID) and Chair of the Worldsteel Economics Committee, noted that despite trade tensions and persistent uncertainties, we are cautiously optimistic that global steel demand will bottom out in 2025 and return to moderate growth in 2026, supported by resilient economies, infrastructure investments, and improving financial conditions.